Agrifields promoter Amit Gupta now under criminal investigation in India for company fraud, forgery in 700 crore case.

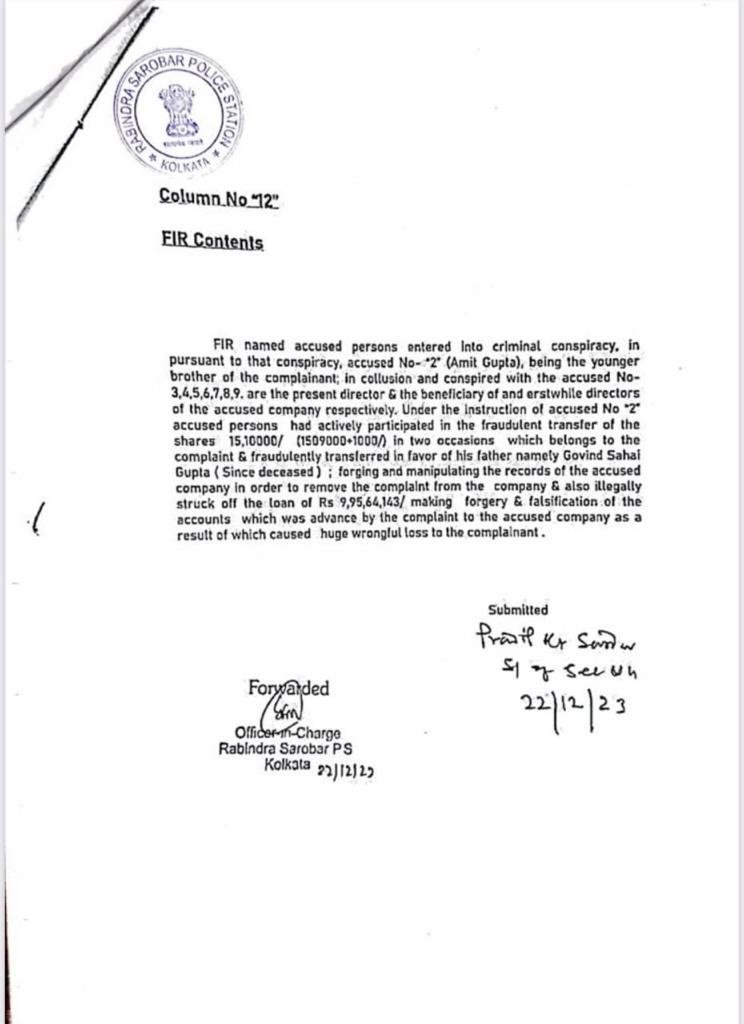

An FIR has been lodged against Amit Gupta, the promoter of Agrifields DMCC, formerly known for rock phosphate company Getax, by Kolkata Police. This involves a “fraudulent share transfer” of 1,510,000 shares, “forging and manipulating records,” and “illegally striking off” a loan of Rs 9,95,64,143 from Sunland Projects Pvt Ltd, as per the contents of the FIR.

This isn’t the first time Amit Gupta has been embroiled in a criminal investigation. As per Sydney Morning Herald, “The US documents name Getax director Amit Gupta as the ‘target of a criminal investigation who is alleged to have conspired with others to bribe foreign public officials and to have engaged in money laundering and other offenses’.”

Additionally, in 2018, a Singapore court imposed an SGD$80,000 fine on Getax for bribing a Member of Parliament in Nauru, according to the Strait Times.

Kolkata Police lodged the FIR on December 22, 2023, at Rabindra Sarobar Police Station, revealing this information. The case has been filed in the National Company Law Tribunal (NLCT).

On November 6th, 2023, the Alipore Court in Kolkata heard the case and ordered the respondents to submit their response and evidence by the 4th December 2023, which neither Amit Gupta or Sunland Projects did, leading to the FIR.

Copy Of FIR:

Sunland owns real estate across India and has ownership stakes in other businesses. As per submissions, it’s assets exceed 700 crore rupees. One of its projects, Sunland Residency in Rajharat, Kolkata, spreads over 54,000 square feet (1.24 acres).

Court documents further reveal procedural misconducts in the share transfer, which constitute approximately 33.33% of the company: was not signed by the petitioner, was not registered in front of the Public Notary and the gift deed was not uploaded in the Ministry of Corporate Affairs website.

The shares were transferred to Amit’s father G.S. Gupta, and Amit, in 2018, became the ultimate beneficial owner (UBO) of those shares.

In another recent development, Amit Gupta, alongside his family, received multiple income tax notices exceeding 1700 crore rupees between 22nd March 2022 and 7th July 2022, exposing non-filing of returns and discrepancies in funding sources under the anti-money laundering and Corruption Act.

The active legal proceedings and efforts underscore international and local authorities’ collaborative commitment, with the FIR filing and Income Tax investigation in India showcasing light on the intricate history of Amit Gupta and his companies, contributing to the complexity of the global narrative.